Nuances of SDA and when and why will publishers will invest in SDA (part 2)

Trip Foster • November 22, 2022

As with all things adtech… Seller Defined Audiences (SDA) is complicated

(Part 2 in our Seller Defined Audience briefing) See part 1 here

As always, the devil is in the details. The audiences are defined by the publisher, and the buy side doesn’t always ‘buy’ that the audience is what the publisher says it is. Further, each Data Transparency Standard (DTS) may differ if these definitions are haphazardly built – potentially creating a fragmented understanding of what an audience such as “auto intender” means.

As great as the promise is, the effort and complexity of the endeavor to create SDAs are extensive. For many large and most mid-sized or long-tail publishers, the knowledge and tech required to contextually analyze and map users into these different IAB categories, capture accurate and trustworthy demographic information, then these DTS designations (which become Data Labels) is simply too much effort while they are still “keeping the plain in the air”.

Most publishers don’t possess the level of expertise required to do this themselves and will need an adtech partner to complete this process. Theoretically, if a publisher has a DMP, the DMP should be able to provide this service, however, as of this writing, no DMPs are currently offing the creation of SDAs. Also, since DMPs are often structured to primarily support ‘direct sales” their integration into GAM does not necessarily translate into integration into the bid stream. However, there are lightweight alternatives to DMPs that can do this today so a publisher can innovate and cut costs on the myriad of DMP features they are overpaying for. Maybe, more importantly, most publishers won't have scale within an individual segment to match the reach that 3P data provides.

Let’s start by saying it is unclear still that publishers will invest in SDA. As with most adtech advances, the buyers and sellers need to both show up to make a market work, and to date, SDAs that are being leveraged are primarily for testing and proof of concept. So no one is waiving their checkbook yet.

That being said, publishers continue to struggle with diminishing CPMs. Third-party data has allowed buyers and sellers to benefit through the huge expansion of audience inventory and the low cost of programmatic execution. However, within that process, publishers often felt that they had ‘given their readers away’ by allowing Third-party data providers to disaggregate the relationship between the publisher and their audience.

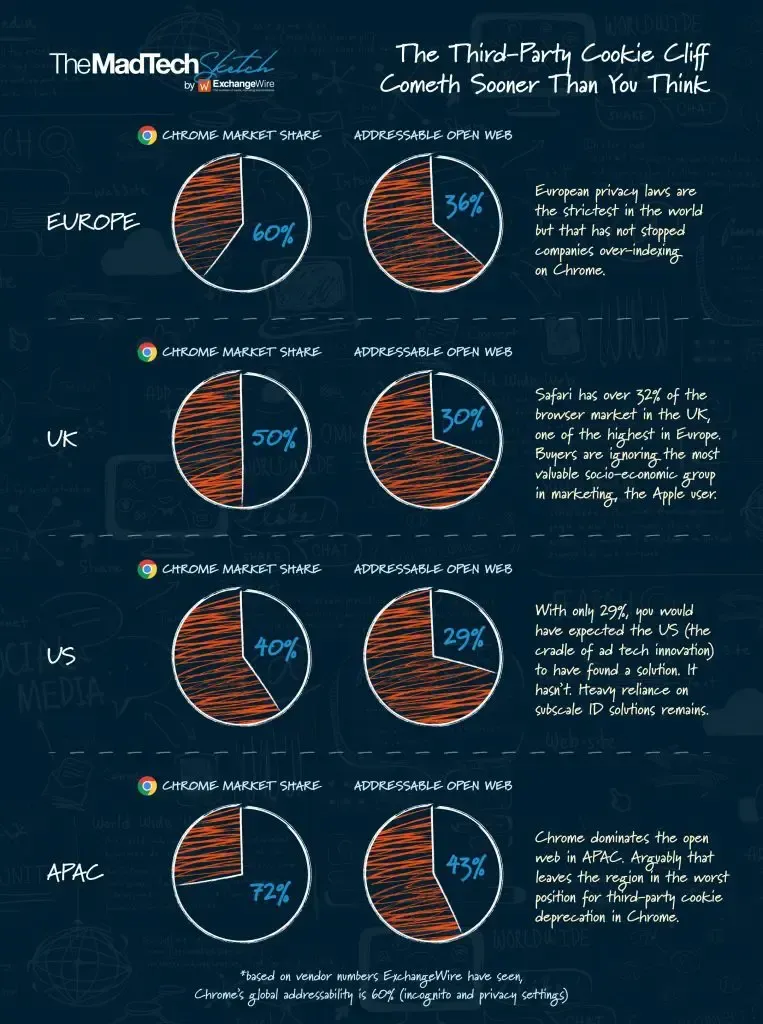

But the truth is that 3P data, while still around with Chrome, continues to shrink its reach. Safari is claiming a larger and larger portion of U.S. traffic and the lack of 3P data with those impressions is crushing CPMs.

SDAs theoretically solve that problem. They make 100% of a publisher's audience “identifiable” and should allow for target audiences to be found. The challenge will again be scale. Few publishers are large enough to create their own SDA segment that has the specificity of user and reach. But, on many levels, publishers have no alternative. This downward pressure on eCPMs is due in large part to the blocking of data on IOS traffic is increasing and the Chrome cookie is going away or at least diminishing in value.

And?

So we believe SDAs will become one of the necessary publisher-controlled tools for media owners to navigate through the slow death of the 3P cookie and increase their appeal in satisfaction with the ever-present need for reach for top-of-funnel marketers. The IAB stated in their SDA announcement: “SDA makes no claims of being a silver bullet for the industry, but should be a valuable tool in our toolbox. If you want to learn more about how to lean into SDA and be up and running in Q1, please click here to sign up for a demo.

The GrowthCode Blog

As most know, First-party data refers to the data that publishers collect directly from their website visitors, app users, or other platforms they own. Here are some steps publishers can follow to leverage their first-party data to safely sell their data and build additional revenue lines via existing marketplaces. Data Collection and Segmentation: The first step is to ensure that the publisher is effectively collecting relevant consented first-party data from their users. This data can include demographics, user behavior, preferences, purchase history, and any other information that can help in understanding their audience better. This data can also include PII, like name, address, age, gender, email, etc. This PII information must be managed differently from more generic data. Once collected, the data should be segmented into various audience groups based on common characteristics or interests such as contextual signals or audiences like IAB categories or Seller Defined Audiences. Audience Profiling and Insights: Publishers need to analyze and profile their audience segments to gain actionable insights. This involves understanding the interests, behaviors, and preferences of each segment, which can help in targeting the right advertisers and buyers on site and off-site via marketplace sales of audience data. Data Privacy and Compliance: Before sharing any first-party data with external parties or marketplaces, publishers must ensure they are compliant with relevant data privacy laws and have obtained appropriate user consent for data usage and sharing and are passing this per these legislative structures. Data Packaging and Pricing: Publishers should package their first-party data into actionable segments that align with the needs of potential buyers in the marketplace. Data segments can be based on demographics, interests, intent, or any other relevant criteria. Pricing for these data segments should be set based on their value, reach, and demand in keeping with market rates. Partnering with Data Marketplaces: Publishers can partner with data marketplaces or data management platforms (DMPs) that facilitate the buying and selling of audience data. These marketplaces act as intermediaries, connecting publishers with advertisers or other businesses looking to target specific audience segments. Publishers need to package their 1PD in a fashion to easily pipeline it onto these partners for easy consumption by the demand these marketplaces have aggregated. Data Activation and Onboarding: To share the data with the marketplace, publishers may need to onboard their data onto the marketplace's platform. This process involves securely transferring the data to the marketplace while maintaining data integrity and user anonymity. This could be done using the RampID, Throtle, Eyeota, Fabrick, etc. Additional costs are often incurred for this service. Marketing and Promotion: Publishers can promote their data offerings within the marketplace to attract potential buyers. This can involve showcasing the unique qualities of their data segments and how they can help advertisers achieve their marketing objectives. Ongoing Performance Measurement and Optimization: Publishers should continuously measure the performance of their data offerings in the marketplace. This involves evaluating the demand for different segments, understanding which segments are popular among buyers, and optimizing data packages based on buyer feedback and market trends. Maintaining Data Freshness and Quality: Regularly updating and maintaining the first-party data is crucial to ensure its relevance and accuracy. Fresh and high-quality data will be more appealing to potential buyers. Adhering to Transparency: Transparency is essential in data sharing. Publishers should provide clear information about the data being shared and its source to build trust with potential buyers. Tools such as the data labeling standard from the IAB are great ways to share the provenance of data and build trust with partners. By following these steps, publishers can effectively leverage their first-party data to sell audiences into marketplaces, creating a win-win situation for both publishers and advertisers. Publishers safely generate additional revenue with their 1PD, while advertisers can access valuable audiences without cookies to improve their targeting and advertising efforts.

Introduction : In an era where digital advertising is undergoing massive transformation, online publishers have become more intertwined with advertising technology than ever before. T In order to manage this new symbiosis publishers have to turn over more elements of their operation to their technology partners due to resources, the proliferation of more required/needed technology, and constraints and chasing margin. However, this approach is often accompanied by a growing convoluted opacity that cloaks the intricate mechanisms of this technology, its legal use of consumer data, and proper delivery of accurate information into key ad tech systems. As we steadily migrate to a future that's predominantly online, it's crucial to untangle these convolutions, especially when the stakes involve user privacy and data. The Concern that Never Left: Understanding Advertising Technology and The Black Box: Adtech acts as the backbone of today's digital media landscape. It's the engine behind the ads we see, driving personalized content by leveraging the wealth of user and content data available. From cookies to tracking pixels, the tools it employs offer a refined, audience-centric approach, enabling target ads with unprecedented precision. To maintain this level of accuracy, the industry is migrating away from the use and abuse of third-party cookies and looking to rely on first-party data - renewing a reliance on the publisher’s data. As part of the migration, publishers are presented with the opportunity to reclaim their data assets and control data leakage - effectively regaining control of their company’s metaphorical “oil”. This is a very exciting time for the sell side as the opportunity is significant. However, many solutions force publishers to either expand their internal tech resources or allow vendors to trade data access for control. Be it targeting, audience development and enrichment, or attribution – the existing ad tech toolset is being re-architected by the publisher to accommodate these shifts and leverage this once-in-a-generation shift of power. Unfortunately, the “right” ad tech stack is difficult to define. Yes, everyone basically uses GAM, and the addition of a fraud measurement tool is almost ubiquitous, but the new data playbook is in flux and increasing in complexity with each day. Depending upon how it is calculated, third-party data (3PD)tools make up between 35%~55% of all online advertising spend. Hence, the number of “solutions” to maintain targeting with the loss of the third-party cookie seems to grow exponentially every day. For instance, here are now 48 different ID solutions that have products approved by Prebid plus dozens of other proprietary IDs from SSPs and DSPs. One of the great challenges to the conversion from 3PD to 1PD leaves publishers trying to determine which ID makes sense and provides the highest return on investment. This creates both testing fatigue and significant associated costs of managing the IDs, analysis, and outcomes, some vendors have emerged with their own ID solution, claiming to manage this process in exchange for a revenue share. However, just as we saw with the invasion of 3P cookies and tags on publishers' pages, these black-box solutions create a new risk. As we have seen over the last few months, companies proclaiming to manage this information were actually violating requirements and inappropriately favoring their own IDs over others, overriding established bidding requirements, or finally, illegally substituting data across browsers (bid stuffing). However, this sophisticated interplay often operates as a 'black box' - a term originating from computing to describe systems where the internal workings are hidden. In the realm of ad tech, this term refers to a lack of transparency regarding how user data is processed, who it's shared with, how decisions regarding ad targeting and placement are made, and the legality of the processes in place. For online publishers, this opacity can lead to unexpected and potentially detrimental consequences. In the case of a black box solution, it is unclear what exactly the vendor is doing with the user or publisher data, whether it is being leveraged for uses outside of the publishers' media (data leakage), and if everything that is being done is privacy-compliant (think state and federal governance) and commercially compliant with the terms of other vendors. Risks of Operating in the DarkPotential Legal Implications: Given the global push towards data privacy with regulations like GDPR, CCPA and the bevy of state-level regulations percolating, ignorance about the operations of your ad tech could spell legal trouble and large financial liability. Non-compliance with privacy laws may result in hefty fines, sanctions, and legal action, transforming an opaque ad tech ecosystem into a legal minefield. Brand Reputation and Trust: Trust is the bedrock of consumer and advertiser relations. In the context of advertising technology, transparency can either foster this trust or destroy it. A black box ecosystem can lead to unauthorized data use or ill-timed, irrelevant ads, damaging your brand's reputation and straining consumer trust. For instance, what if a black-box vendor is artificially enriching bids from your portfolio of brands with inaccurate data and reselling them to buyers? Getting Block-Listed by Demand Sources: Unfortunately, tracking an understanding of who is bidding on a publisher’s inventory is already complex. Publishers get block-listed by DSPs and SSPs for perceived infractions, questionable traffic, bad “ads.txt” files, and many other reasons. However, in most cases, publishers are unaware of this until it is too late. Now, adding to this list of reasons is the mishandling of IDs. This issue will grow as more publishers adopt leveraging Universal IDs and their own first-party data. Ineffective Targeting and Ad Placement: The black box phenomenon also threatens ad effectiveness. With an understanding how your ad tech operates, it's easier to ensure that ads are appropriately targeted and placed. This can lead to ad misalignment, a poor user experience, and ultimately, reduced return on investment. This also creates a reliance on the reporting by the technology provider, since their actions are shrouded, thereby lacking the tools to measure the effectiveness of these tools. “We give you lift” without clearly saying how is the hallmark of many of these offerings. Strategies for Mitigating Risks Demanding Transparency: It's time for publishers to assert their need for transparency, especially if they want to protect this new found value of their currency. Ask vendors tough questions about data usage, sharing policies, how their systems work with other systems, what specific data is passed and when, where the publisher data is going, and decision-making processes. Insist on clarity regarding who has access to data and the measures in place to secure it. Its a good rule of thumb, that if they can’t explain it so you can understand it, they are doing something suspect. Data Governance and Partnerships: Establishing robust data governance policies is paramount. These should include clear roles and responsibilities, compliance checkpoints, and defined processes for data handling. Building a solid partnership with your ad tech provider, grounded in open communication and shared values, is equally vital. Exploring Alternatives: Obviously, effectively managing user consent and respecting user privacy is paramount. If you lose the trust of your readers, you're dead. However, as publishers consider alternatives, two issues are paramount. - ALWAYS know what is being done with your data. This shift from third-party data to first party data is a huge opportunity for publishers, but in their race to control expenses and technology stacks, most publishers will opt for the ad tech solution that promises them money without risk. This is a recipe for once again losing control of your data and becoming marginalized . - Avoid locking yourself into one solution. There are literally dozens of different IDs emerging and more companies offering their path through the transition to first-party data. There is no clear winner yet. So, as long as the partners are transparent, maximize the value of your first-party data in a way that supports your long term viability - not the fortification of another vendor’s ID graph. Conclusion: Advertising technology, when shrouded in a black box, presents a labyrinth of risks for online publishers. However, through proactive steps toward transparency, a commitment to robust data governance, and an openness to explore alternative commercial models, these risks can be mitigated. Remember, while ad tech may be an essential tool in your arsenal to take back control of your first-party dat , it should be one that works for you, not one that leaves you operating in the dark and assuming risks you aren't aware of.

Universal IDs ( UIDs ) are a type of identifier that can be legally used to track users across multiple websites. They are designed to replace third-party cookies, which are small pieces of data that are stored on a user's computer when they visit a website. Third-party cookies have been criticized for their privacy implications, and many browsers are phasing them out. UIDs are created by combining a user's device ID, browser fingerprint, and other pieces of data. This unique identifier can then be used to track the user's browsing activity across multiple websites. UIDs can be used for a variety of purposes, such as targeting ads, measuring website traffic, and preventing fraud. There are a number of different UID solutions available, including: Shared ID: SharedID is a publisher-controlled identifier that aims to help publishers serve targeted ads to their users by leveraging user IDs. It is a pseudonymous identifier that is not reliant on cookies or mobile ad IDs. SharedID is created by the SharedID.org consortium, which includes publishers, ad tech companies, and privacy advocates. SharedID works by creating a unique identifier for each user that is based on their browser fingerprint and other device-specific information. This identifier is then shared with advertisers and other parties in the ad tech ecosystem. This allows advertisers to target ads to users based on their interests and browsing behavior. Panorama ID: Panorama ID is a global, people-based, identity solution for the open web. It is built from multiple inputs (web, mobile, CTV, and customer-specific IDs). The ID is freely accessible to and interoperable across the cookie-challenged web. Panorama ID is a pseudonymous identifier that is not reliant on cookies or mobile ad IDs. It is created by Lotame, a global data solutions provider. The Trade Desk's Unified ID 2.0: The Trade Desk is a marketing technology company that has developed a UID solution that is based on first-party data. This means that users have to opt-in to be tracked, which protects their privacy. LiveRamp's Identity Graph: LiveRamp is a data management platform that helps companies connect their first-party data with third-party data. This allows companies to create more accurate profiles of their customers, which can be used for a variety of purposes, such as targeting ads. Transunion/ Neustar/Fabrick: The Fabrick ID is a pseudonymized identifier that brands use to create cross-media linkages between advertiser demand and publisher inventory. The Fabrick ID is compatible with all major programmatic ID solutions, including LiveRamp ATS, UID2.0, and Unified ID 2.0. It is also compatible with the IAB Tech Lab's Transparency & Consent Framework (TCF). ID5 : ID5 is an identity provider that helps publishers and advertisers connect with their audiences in a cookieless way. ID5's solution provides a stable, consented, and encrypted user ID to replace third-party cookies and mobile ad IDs. ID5 works by creating a unique identifier for each user that is based on their device fingerprint and other device-specific information. This identifier is then encrypted and stored in ID5's secure servers. Publishers and advertisers can then use this identifier to target ads to users, measure the effectiveness of their campaigns, and track user engagement. UIDs are a promising alternative to third-party cookies. They offer a number of advantages, such as improved privacy, better targeting, and fraud prevention. However, UIDs are still a relatively new technology, and it is not yet clear how they will be adopted by the wider industry and over-reliance on a single vendor for these services can get a publisher into trouble as these businesses change strategy, pricing or financial solvency status. Here are some of the benefits of using UIDs: - Improved privacy vs the 3rd party cookie: UIDs can help to improve user privacy by making it more difficult for advertisers to track users across multiple websites. - Targeting without a third party cookie: UIDs can help advertisers to target their ads without the cookie by providing them with an accurate understanding of their target audience. - Reduced data leakage: UIDs theoretically protect publisher data better due to the fact that they do not share data across other vendors (as 3rd party cookies do). However, there are also some drawbacks to using UIDs: - Increased complexity: UIDs can add complexity to the advertising ecosystem, as advertisers will need to learn how to use them effectively and publishers need to work hard to manage multiple vendors and syne them to their user data - Lack of transparency: some UIDs are not as transparent which could make it more difficult for users to understand how their data is being used. - Frustrating and cumbersome to test: Many publishers are frustrated with the testing process and have developed testing fatigue due to the time and effort these test consume. - Cost: To run a full-fidelity ID graph, publishers need to support multiple UIDs to maximize their addressability from all the various demand partners that use these UIDs (DSP, SSP, Agency, etc). This process can get expensive and time consuming and confusing if you don’t have a good partner to support you. - Over-reliance: becoming dependent on only one UID is not a sound strategy. Publishers need to take a distributed strategy for UID partners. Support for many UIDs will increase addressability and maximize higher bid density. While more costly, the benefits of maintaining a graph with multiple UIDs is seen to be a better strategy and reduces dependency on a single ‘currency’. While the new data-driven publisher stack will be as different as the new revenue portfolio for publishers, the universal identifiers have an important role to play to keep publishers revenue streams intact and functioning within the expectation of buyers. To learn more about how you can leverage GrowthCode’s identity and data infrastructure to build your own ID graph, click here .

We asked Chat GPT about its potential impact on online publishing. This is it's response: The GPT (Generative Pre-training Transformer) is a type of language model developed by OpenAI that uses machine learning techniques to generate human-like text. It has the ability to generate text that is coherent and flows naturally, making it a useful tool for tasks such as machine translation, language summarization, and text generation. In the context of online publishing, GPT and other language models like it have the potential to transform the way content is produced and distributed. For example, GPT could be used to generate articles, blog posts, or other written content automatically, potentially reducing the need for human writers in some cases. GPT could also be used to help with tasks such as editing and proofreading, as it is able to identify and correct errors in written text. However, it is important to note that GPT and other language models are not yet able to fully replace the creativity and nuance that human writers bring to the table. While these models may be able to generate coherent text, they may not always be able to capture the unique perspective and voice of a human writer. As such, it is likely that GPT and other language models will continue to augment rather than replace human writers in the online publishing industry.